A Deep Dive into Crypto Mining Equipment

As someone with over two decades in the crypto mining industry, I have witnessed a dynamic evolution in technology and strategies. Crypto mining equipment has grown from basic setups to intricate systems designed to maximize efficiency. Whether you are venturing into your first mining endeavor or optimizing a significant operation, understanding the current landscape is crucial for success.

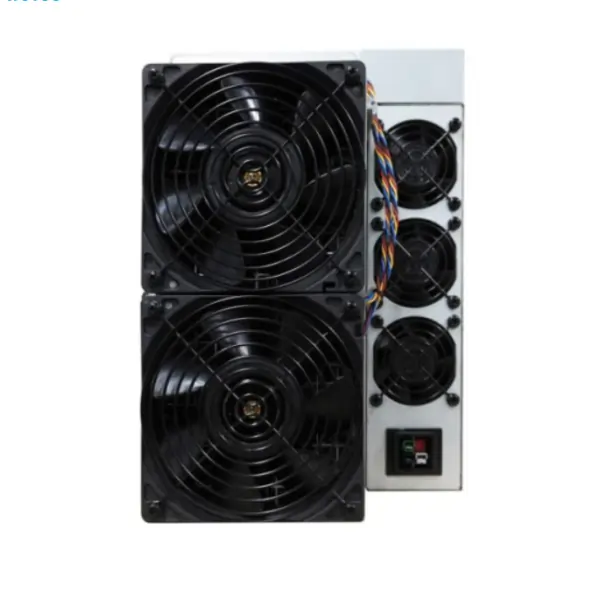

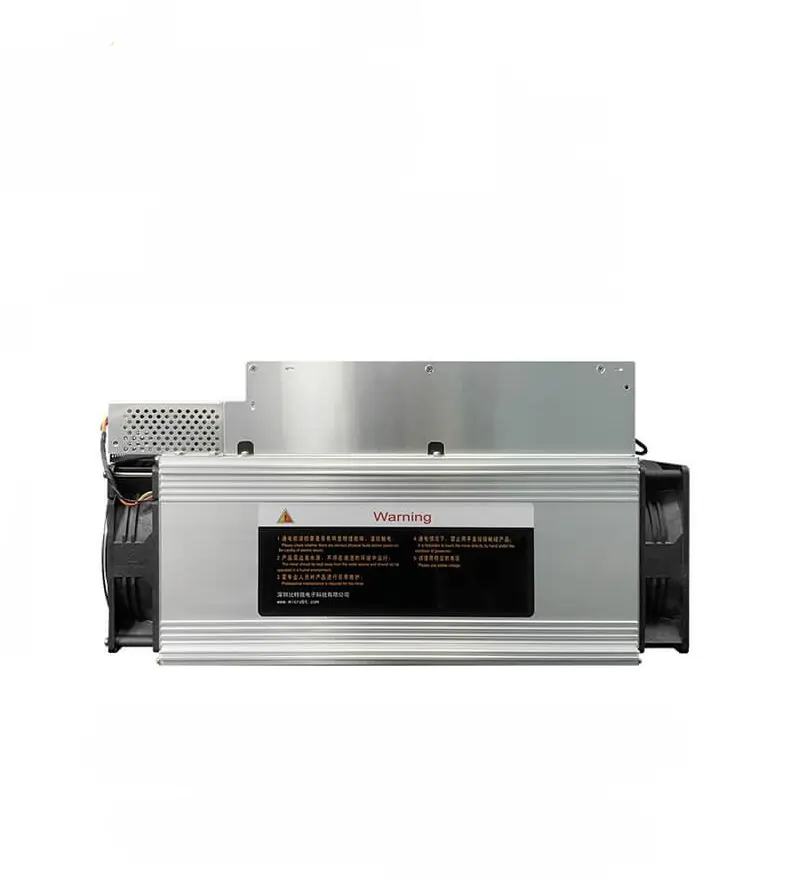

Crypto mining equipment is essential for any cryptocurrency enthusiast aiming to mine digital coins like Bitcoin or Dogecoin. The heart of these operations typically centers around ASIC miners, known for their efficiency and reliability. These devices focus on specific algorithms to crunch numbers, solve complex puzzles, and earn cryptocurrency rewards.

How to Choose the Right Crypto Mining Equipment?

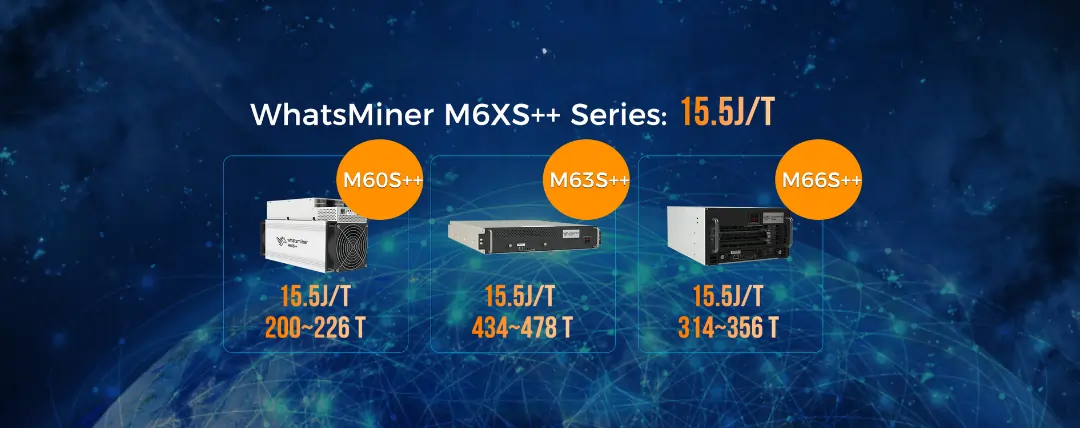

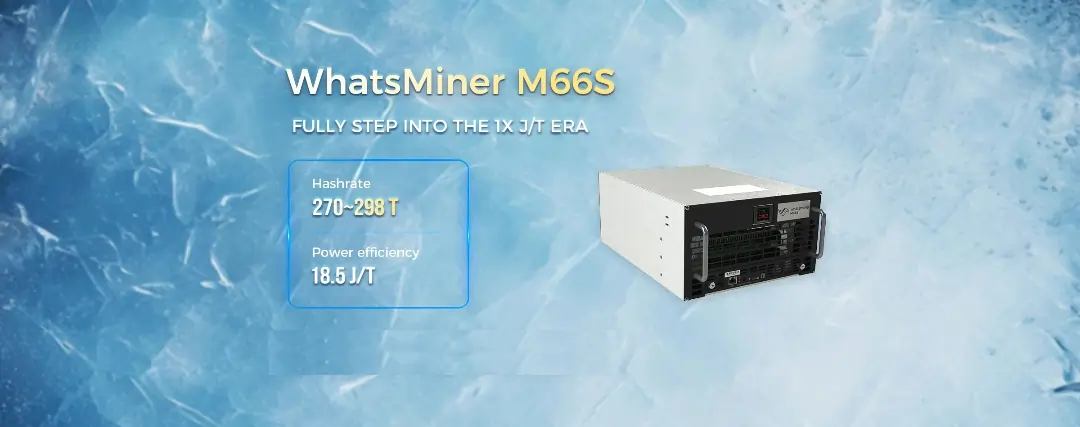

Choosing the right equipment can be daunting, but it boils down to a few key factors. Begin by evaluating the energy efficiency of potential options since electricity costs significantly impact profitability. Another vital component is the hashrate -- a measure of computational power. A higher hashrate equals faster production, but it often comes at an increased cost and power consumption.

Looking for flexibility? Consider your cooling options. Modern crypto mining equipment may employ air cooling, hydro cooling, or even liquid cooling systems. These choices can influence not only the efficiency and longevity of your equipment but also your operational costs.

To assist in this decision-making process, here are some steps:

- Determine your budget and calculate potential electricity costs.

- Research different mining algorithms and their requirements.

- Compare different equipment manufacturers for reliability reviews.

- Consider the scalability of your system for future expansions.

Financial Impacts of Mining Equipment

Beyond initial purchase costs, you must account for ongoing operational expenses. Electricity consumption is a critical expense, so opting for energy-efficient crypto mining equipment is essential. Some of the latest models incorporate innovative cooling technologies that decrease power usage without compromising performance.

From a financial perspective, the equipment's ability to deliver consistent output with minimal downtime is priceless. Looking back at my experience with various setups, I recall a shift a few years ago when manufacturers started focusing on durability and longevity. It has become a significant selling point, as the longer your equipment lasts, the higher the return on investment.

Finally, understand that every investment carries risk. The volatile nature of cryptocurrency values means profits can shift dramatically. Diversifying your mining portfolio and staying informed can help mitigate some of these risks.

Crypto mining equipment raises many questions among both novices and veterans. Here are some frequently asked questions:

- Why does cooling matter for mining equipment? Efficient cooling extends the lifespan of hardware and improves energy efficiency, reducing costs.

- How often should I upgrade my equipment? It depends on technological advancements and mining difficulty. Regularly assess your hashrate and power consumption against newer models.

- Is used equipment a viable option? While cheaper upfront, used equipment may have reduced efficiency and lifespan, leading to higher long-term costs.

Staying informed and proactive in assessing these aspects ensures you make decisions that align with your mining goals and financial constraints.

The Future of Crypto Mining Equipment

As we look ahead, the future of crypto mining equipment appears promising yet challenging. Innovation is accelerating, with emerging technologies poised to revolutionize efficiency and sustainability. Upcoming trends may include enhanced miner coordination and AI integration to optimize operations automatically.

Whether you're an experienced miner or just starting, staying aware of these advancements is crucial. The industry is poised for significant changes, and early adopters of new technologies will likely reap the benefits. However, it is essential to balance between chasing the latest innovations and maintaining a stable, reliable setup.

In my two decades in the industry, I've witnessed the rapid pace of changes and the opportunities they create. It's an exciting time to be invested in crypto mining equipment, where every advancement offers the potential for greater rewards.

What makes ASIC miners crucial for crypto mining operations?

ASIC miners are essentially the backbone of modern cryptocurrency mining operations due to their unparalleled efficiency and specialization. These devices are tailored to perform computations specifically for blockchain algorithms, which allows them to mine cryptocurrencies much faster and more efficiently than general-purpose hardware like GPUs or CPUs. For example, when I first started in the industry two decades ago, the shift to ASICs from less specialized equipment marked a significant leap in profitability for miners. The key is their ability to provide high hashrates while maintaining energy efficiency, reducing both environmental impact and operational costs. For anyone venturing into mining today, investing in ASIC miners is almost mandatory if you aim to compete effectively in the market.

How should one evaluate the financial viability of investing in crypto mining equipment?

Evaluating the financial viability of crypto mining equipment revolves around understanding both the initial costs and ongoing expenses. Start by assessing the equipment's energy efficiency and how that translates to electricity costs--which can differ dramatically depending on your location. For instance, a miner operating in a region with low electricity costs might find high-power consumption more tolerable compared to someone in a high-cost area. The equipment's hashrate is another crucial factor; higher hashrates often mean greater potential earnings but usually come with increased energy consumption. It's also wise to consider the potential profitability of the specific cryptocurrency you're targeting, as volatility in crypto values can significantly affect returns. Lastly, think about the longevity and reliability of the equipment--will it require frequent upgrades? Over time, consistent performance with minimal downtime significantly influences the return on investment.

Why is the choice of cooling system so pivotal in crypto mining equipment?

The cooling system in crypto mining equipment plays a critical role in maintaining optimal performance and extending the lifespan of your hardware. Efficient cooling systems, whether air, hydro, or liquid-based, help prevent overheating, which is a common cause of hardware failure. Back when I managed multiple mining rigs, a switch to more advanced cooling reduced maintenance downtimes and energy waste. This also translates to lower operational costs, as overheating components often require more power to operate and can incur hefty repair expenses. Choosing the right cooling setup not only impacts immediate efficiency but also long-term hardware reliability. It's essential to consider the environment where your equipment will run--different setups might favor varied cooling methods. Have you considered how your geographical location and climate might influence your cooling needs?

Is opting for used crypto mining equipment a wise decision?

Choosing between new and used crypto mining equipment depends heavily on your specific needs and financial situation. New equipment offers the latest technology, often providing better energy efficiency and longer lifespan, which can be crucial in maintaining high productivity levels. On the other hand, used equipment can be a more affordable entry point for beginners or smaller operations. However, it's important to consider potential downsides, such as diminished efficiency and the risk of early failure due to previous wear and tear. Personally, I've found that while used equipment might save money upfront, the long-term costs of repairs and replacements often offset initial savings. It's vital to weigh the initial savings against potential future expenses. Have you calculated the long-term operational costs of new versus used equipment in your mining strategy?

What future trends should miners expect in crypto mining equipment?

The future of crypto mining equipment is brimming with potential advancements that promise increased efficiency and sustainability. Innovations like AI integration for automatic optimization of mining operations and enhanced miner coordination are on the horizon. These technologies could significantly lower costs and increase profitability by making mining processes more adaptive and resource-efficient. Reflecting on the rapid pace of change I've witnessed in the industry, staying ahead of these trends can provide a competitive edge. It's an exciting time as the market is set for waves of innovation that could redefine mining efficiency. For instance, I recall when the industry transitioned to ASIC miners--early adopters reaped substantial rewards. Are you prepared to adapt to these changes and incorporate new technologies into your operations?